Refinitiv FX volumes hit a fresh year high in March

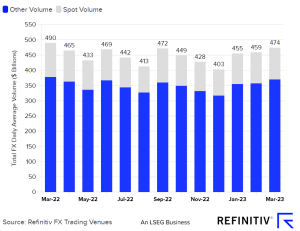

Refinitiv, the former Financial and Risk business of Thomson Reuters, reported that the average daily volumes (ADV) of currency trading were $474 billion in March on the company’s main FX trading services. March’s ADV figure was the highest in twelve months.

Foreign exchange (FX) trading volumes were influenced by a range of factors in March, including economic and political events, market volatility, and changes in investor sentiment. One key driver of increased FX trading volumes in March was heightened market volatility. This volatility created opportunities for traders to make profits by taking advantage of short-term price movements.

Foreign exchange trading volumes across Refinitiv Matching and FXall platforms were up by 3 percent from $459 billion in February 2023. The figure was, however, down -3.3 percent from $490 billion in March 2022.

Spot FX volumes at Refinitiv, still partly owned by Thomson Reuters, came in at $104 billion, representing a 2 percent rise over the monthly interval when compared to $102 billion in February. On a yearly basis, the spot turnover failed to outpace its counterpart of March 2022, which came at $112 billion.

A stronger activity in other transaction types, including forwards, swaps, options and non-deliverable forwards (NDFs), contributed to the monthly rise, having clocked in their best month in 2023. The figure averaged $370 billion daily, which is up 3.6 percent from $357 billion in the previous month.

Refinitiv is a global provider of financial market data and infrastructure, serving over 40,000 institutions in over 190 countries.

Refinitiv’s FX business offers a variety of products and services for institutional clients, including pricing and analytics tools, trading platforms, and post-trade solutions. Its flagship product, Refinitiv FXall, is a leading electronic trading platform that connects clients with over 1,800 liquidity providers, enabling them to execute trades in more than 150 currencies. The platform offers a range of trading options, including spot, forward, swap, and non-deliverable forwards (NDFs), and provides users with real-time market data and analysis.

In addition to its trading platform, Refinitiv’s FX business also offers a suite of analytical tools and data services, including Refinitiv Eikon, which provides real-time news, market data, and analysis, and Refinitiv Dealing, a platform for interbank trading. Depending on their business model and market conditions, Refinitiv Elektron offers partners an ultra-low latency order routing and pricing engine, also giving the institutions the opportunity to connect to a wide range of liquidity providers. This includes cross-asset market and pricing data, providing 9 million prices updates per second over 84 million instruments and 2.5 terabytes of real-time pricing daily.